Welcome to Economics International Inc (EII), a Washington DC research and consulting corporation. This website features the research of William R. Cline, President of EII.

FEATURED RESEARCH

Trump’s Global Tariff War: Faulty Premises, Costly Consequences. Working Paper 25-1

The Trump Global Tariff War (TGTW) has discarded US commitments to the postwar international trading order established under the GATT and WTO. It replaces the Most Favored Nation principle with an “Every Nation Different” principle under the false premise that any economy with a trade surplus against the United States must be cheating on its trade obligations, and imposes a “reciprocal” tariff increase based on the ratio of bilateral US imports to exports. It fails to recognize the role of US fiscal deficits in boosting demand for imports, and of the attractiveness of the US capital market to inflows of foreign capital in strengthening the dollar and contributing to a persistent trade deficit. The TGTW promises revival of US manufacturing jobs under the false premise that trade deficits rather than technological change and Engels Curve shifts in demand toward services have driven the decline in the share of manufacturing in employment and GDP. It shows no recognition that higher tariffs are a self-inflicted wound to the economy because of large static welfare triangle costs and loss in dynamic efficiency growth. This study estimates that the 18 percent rise in tariffs so far in the TGTW imposes an ongoing future static welfare cost of 0.28 percent of GDP. The medium-term dynamic efficiency loss brings the total welfare loss reaching a range of 1.1 to 2.3 percent of baseline GDP by 2035. (See Working Papers.)

Long Term Fiscal Consequences of Harris Versus Trump. Research Note 24-1

This note calculates that US federal debt is already on a dangerous path, rising from 99 percent of GDP in 2024 to 173 percent by 2054. Extending recent estimates by the Committee for a Responsible Federal Budget, it calculates that the Trump campaign fiscal proposals would boost the 2054 debt ratio to an expected 223 percent of GDP, and even the Harris proposals would raise it to 196 percent of GDP. (See Working Papers.)

Forest Fires and Carbon Sequestration. Working Paper 24-1

Despite the recent global increase in forest fires, the planting of trees in new areas and previously deforested areas remains a major and relatively low-cost approach for sequestering carbon dioxide. Even with projected increases in the incidence of forest fires as the climate warms further, the loss of carbon to forest fires would remain relatively low. Damage from additional fires associated with increased forest area would be much smaller than the benefit from additional carbon sequestration. (See Working Papers.)

Fighting the Pandemic Inflation Surge of 2021-2022. Working Paper 23-1

The Covid-19 pandemic, aggravated by the Russia-Ukraine war, unleashed the worst inflation in four decades in the United States and other advanced economies. This study reviews the contributions of supply shortages and excess demand to the inflation surge. It argues that too little attention was given to the need to finance pandemic relief through higher taxes, and to focus relief expenditures efficiently. Only about 40 percent of pandemic fiscal relief was focused on sectors and recipients most affected by the pandemic. The analysis posits a “fiscal quantity theory” whereby, under constrained supply, an increased fiscal deficit causes increased inflation proportionate to the resulting rise in demand relative to GDP. Calculations applying this approach to the timing of increased demand from fiscal relief, under alternative assumptions about severity of the supply constraints to US supply, find that fiscal pandemic relief contributed one-third to two-thirds of the total cumulative pandemic price shock amounting to 7.7 percentage points above baseline inflation over 2020-2022. The analysis urges greater attention to 6-month annualized inflation as a metric for monitoring progress in fighting inflation. This measure shows that trend US inflation fell from a peak of about 7½ percent in June 2022 to about 4½ percent in January 2023. As a possible supplementary policy instrument to curb still high inflation if needed, it suggests a contingent version of the income-tax surcharge employed in the United States in the late 1960s. (See Working Papers.)

2022 Book

Available here

In this collection of his recent papers, Cline first examines US data on median household incomes over the past sixty years, finding that incomes have risen considerably more than the prevailing political-economic wisdom recognizes. His study on the China trade shock finds that US job losses were fewer than half the number estimated in the most widely cited previous studies. He provides new estimates of Fundamental Equilibrium Exchange Rates. He develops a model of the Justified Stock Market Price.

Cline estimates a “reduced form” model of warming against cumulative carbon-dioxide emissions. He also calculates the appropriate level for carbon-equivalent consumption taxes on meat in the United States. He critiques the pre-pandemic trend toward nonchalance about higher public debt, and projects debt and interest burdens rising to precarious levels by 2050. He also provides debt projections for five emerging market economies with relatively high indictors of debt risk.

Debt Sustainability in Emerging Market Economies after the Covid-19 Shock (November 2021). — The Covid-19 pandemic has imposed major fiscal shocks to emerging market economies (EMEs) from output and revenue loss and from relief expenditures and government credit support. In some economies there has been partially compensating alleviation from lower interest rates. This study examines debt burden metrics for 11 major EMEs to gauge the severity of the shock. It confirms the prevalent perception that Brazil, South Africa, and Turkey have experienced the most severe deteriorations in public debt sustainability, and identifies Colombia and India as also warranting caution. Mexico and Indonesia comprise a middle-risk tier; and Chile, Philippines, Malaysia, and Thailand, a low-risk tier. An important difference from debt crises in the 1980s and 1990s is that EME sovereign debt is now primarily in domestic currency and owed to domestic holders, reducing vulnerability to exchange rate depreciation and the relevance of externally coordinated debt relief. Medium-term projections examining the sensitivity of debt burdens to upward pressure on real interest rates find Brazil, South Africa, and India relatively more affected as a consequence of relatively high baseline debt and interest burdens. Overall, so far there has been no generalized slide of the major emerging market economies into unsustainable debt burdens requiring debt renegotiation with partial forgiveness. However, it will be important for the countries more at debt risk to achieve their baseline improvements in primary fiscal balances currently projected by the International Monetary Fund. (See Working Papers.)

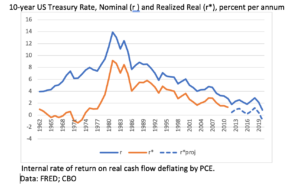

US Debt Sustainability Under Low Interest Rates and After the Covid-19 Shock (March 2021; rev. June). — US federal debt held by the public rose from 35 percent of GDP in 2007 to 72 percent in 2015, reflecting the Great Recession as well as rising health and social spending, and then to 79 percent in 2019 following the 2017 tax cuts. In 2020-21 federal assistance to address the Covid-19 shock will reach over 25 percent of 2021 GDP. The prolonged trend of declining real interest rates since the early 1980s has reduced the real economic burden associated with a given debt to GDP ratio. In part because of new attention to interest rate versus growth rate dynamics, economic thinking has correspondingly shifted toward less concern about debt levels. Nonetheless, Congressional Budget Office projections adjusted for the $1.9 trillion American Rescue Plan indicate that the interest burden will rise from the recent 1½ percent of GDP to 2.3 percent by 2030 and 8.4 percent by 2050, as the debt ratio rises to 114 percent of GDP and 203 percent respectively. Feedback from the rising debt ratio boosts the real interest rate in the CBO’s model to about 1 percent by 2030 and 2½ percent by 2050. This study first estimates the ex-post realized real interest rate on federal debt over the past six decades. For projecting the debt burden, it suggests a prudential benchmark at the 33rd percentile in the past distribution, a real rate of 1 percent on the 10-year treasury note. Simulations of the CBO-based projections using this rate, which is higher in the 2020s but lower thereafter, find an interest burden of 4.7 percent of GDP by 2050, far above the average of 1.9 percent over the past six decades. At a real rate of 1 percent, classic Maastricht fiscal targets would shift to about 130 percent of GDP for the debt ceiling and 4 percent for the deficit. However, even these more lenient targets would not be met unless primary deficits are cut to about 1 to 2 percent of GDP, well below their current path rising from about 3 percent of GDP to 4.5 percent by the 2040s as social security and especially health outlays escalate. (See Working Papers.)

Carbon-Equivalent Taxes on US Meat (July 2020; rev. December). — Almost 6 percent of US greenhouse gas emissions come from methane and nitrous oxide in the livestock sector. This study calculates carbon-equivalent consumption taxes for beef, milk, pork and chicken that could accompany fossil-fuel taxes or regulations in the rest of the economy. Beef production is much more emissions-intensive than that of pork or chicken. Methane from digestion of plant material (enteric fermentation), almost entirely from cattle, accounts for almost half of emissions. At a social cost of carbon dioxide of $75 per ton, the carbon-equivalent tax would be about 20 percent of average retail prices for beef, 4 percent for milk, and about 3 percent for pork and chicken. Compensation to low-income households would be appropriate, as would partial exemption for certified farms and ranches once low-emission feeding and genetic techniques become clearer or widespread testing of animals for enteric methane becomes feasible. (See Working Papers.)

Transient Climate Response to Cumulative Emissions (TCRE) As A Reduced-form Climate Model (May 2020). — This study examines the paradox that the path of realized global warming by a given year is linear in cumulative emissions of carbon dioxide even though the corresponding eventual equilibrium warming is only logarithmic in atmospheric concentration. It attributes this paradox to the legacy effect of a large atmospheric stock of natural and anthropogenic carbon dioxide relative to current emissions, a rising fraction of emissions retained in the atmosphere, and a rising path of emissions. The study then estimates parameters relating realized warming to cumulative emissions using estimates in Coupled Model Intercomparison Project 5 (CMIP5) for the high-emissions scenario of the Intergovernmental Panel on Climate Change (RCP8.5). These estimates constitute a transparent reduced-form climate model that can be useful for analyzing the economic costs and benefits of alternative abatement scenarios. (See Working Papers.)

Calculating the China Shock to US Employment: An Input-Output Labor-Accounting Approach (March 2020). — This study uses input-output labor-accounting to estimate the impact of rising imports from China on US employment. Our counterfactual analysis incorporates offsets from substitution for imports from other countries, increased US exports to China and induced exports to other countries, and job gains in downstream sectors using imported inputs. The study finds that from 2000 to 2016, the China shock displaced 716,000 direct and indirect jobs in manufacturing, 14.3 percent of the period’s decline, but created 39,000 jobs in non-manufacturing. The net loss of 676,000 jobs was far below widely cited estimates of about 2 million divided evenly between manufacturing and non-manufacturing. (See Working Papers.)

Fundamental Equilibrium Exchange Rates (FEERs)— From 2008 through 2017, Dr. Cline published semi-annual estimates of FEERs at the Peterson Institute for International Economics. During 2018-24, EII continued these reports on a subscription basis. The studies from that period are now available to the general public, and are posted in the final section of the Publications page.

Analyzing the international economy,

ABOUT EII

Economics International Inc is a sub-chapter S corporation established in 1981. In its first decade, it provided the Latin American Economic Outlook on a subscription basis, producing a total of 40 reports on the largest Latin American economies. In 1987 EII published the monograph Informatics and Development.

In the 1990s and early 2000s, EII provided major individual economic studies on Venezuela, Argentina, and Brazil for official-sector and corporate clients, in addition to expert witness work regarding valuation of sovereign debt. From 2006 to 2015 the corporation’s work focused on economic translations. In October 2018 EII launched its website featuring Dr. Cline’s ongoing policy research (see Working Papers). This site also provides a compilation of Dr. Cline’s past work (see Publications).

exchange rates,

BIOGRAPHY

William R. Cline is President of Economics International Inc. He is Senior Fellow Emeritus at the Peterson Institute for International Economics (PIIE), where he was a Senior Fellow from the Institute’s inception in 1981 through 2017. He was formerly Senior Fellow at the Center for Global Development, where he held a joint appointment with PIIE; Deputy Managing Director and Chief Economist at the Institute of International Finance; Senior Fellow at the Brookings Institution; Deputy Director for Trade and Development Research at the US Treasury Department; Ford Foundation Visiting Professor in Brazil; and Lecturer and Assistant Professor at Princeton University. He received a PhD in Economics from Yale University and graduated summa cum laude from Princeton University. He is the author of 26 books and numerous articles.

and financial markets

CONSULTING SERVICES

EII provides specially commissioned research tailored to the needs of individual clients. To inquire, please contact: wrc@econintl.com.

DISCLAIMER

The use of all information and analysis provided at this website is subject to agreement to the terms indicated in this disclaimer.